Award-winning PDF software

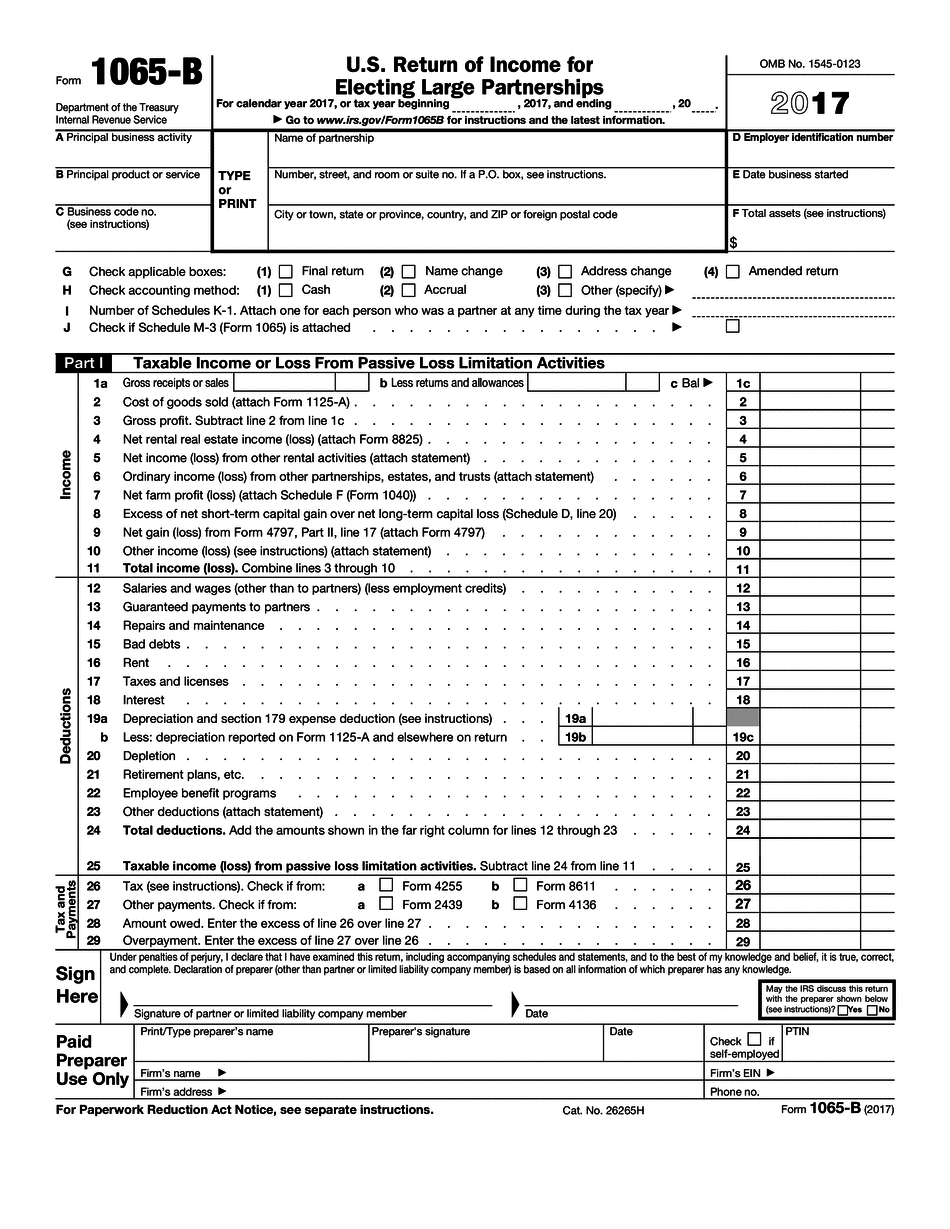

Us Return Of Partnership Income - Internal Revenue Service: What You Should Know

Form 709, Partnership Business Income Tax Return for Individuals (PTE); Information Return; Publication 969; IRS Pass-thru entity (PTE) tax is an alternative tax on partnerships that provides tax relief on taxable income of the partnership for owners' share and certain other income and expense items from a partnership, even where the PTE corporation is taxed. Income of a PTE corporation is disregarded for federal income tax purposes if: (1) A tax is imposed by a State on the business activities that conduct the business of the PTE and the taxes are determined through collection of Federal income tax (and, where applicable, State income tax) on income derived from the business activities that conduct the business (e.g., tax on dividends) or (2) the PTE entity is a non-corporate entity that is not treated as a corporation for Federal tax purposes. For information on tax rules on the conduct of business of an entity that is not a business and is treated as a partnership or not a non-corporate entity, see IRS Publication 606. Pub. 969 Pass-through entity (PTE) tax is an elective tax on partnerships (other than a publicly traded partnership under Internal Revenue Code (IRC) Section 7704) and includes income and profit for purposes of applying certain credit and deduction rules. Publication 969, also known as the Publication 969 for Personal Property, may be ordered from the IRS and may be obtained at the following locations: Treasury Retail Stores or Treasury Retail Branch — — Wisconsin Department of Revenue Pass-through entity (PTE) tax is an elective tax on partnerships (other than a publicly traded partnership under Internal Revenue Code (IRC) Section 7704) and includes income and profit for purposes of applying certain credit and deduction rules. Publication 969, also known as the Publication 969 for Personal Property, may be ordered from the IRS and may be obtained at the following locations: Treasury Retail Stores or Treasury Retail Branch — 26 CFR §1.

Online choices assist you to to organize your document management and improve the productiveness of the workflow. Adhere to the quick manual with the intention to finished US Return of Partnership Income - Internal Revenue Service, refrain from errors and furnish it within a timely way:

How to complete a US Return of Partnership Income - Internal Revenue Service over the internet:

- On the web site together with the kind, click Initiate Now and go with the editor.

- Use the clues to complete the suitable fields.

- Include your own info and contact knowledge.

- Make certain that you choose to enter suitable info and quantities in best suited fields.

- Carefully verify the content material on the kind likewise as grammar and spelling.

- Refer that will help area when you have any inquiries or tackle our Support crew.

- Put an electronic signature on your own US Return of Partnership Income - Internal Revenue Service together with the help of Signal Device.

- Once the shape is completed, press Carried out.

- Distribute the all set form through e mail or fax, print it out or help you save in your unit.

PDF editor makes it possible for you to make modifications for your US Return of Partnership Income - Internal Revenue Service from any world-wide-web linked device, customise it according to your requirements, sign it electronically and distribute in several approaches.