Award-winning PDF software

2021 Instructions For Form 1065 - Internal Revenue Service: What You Should Know

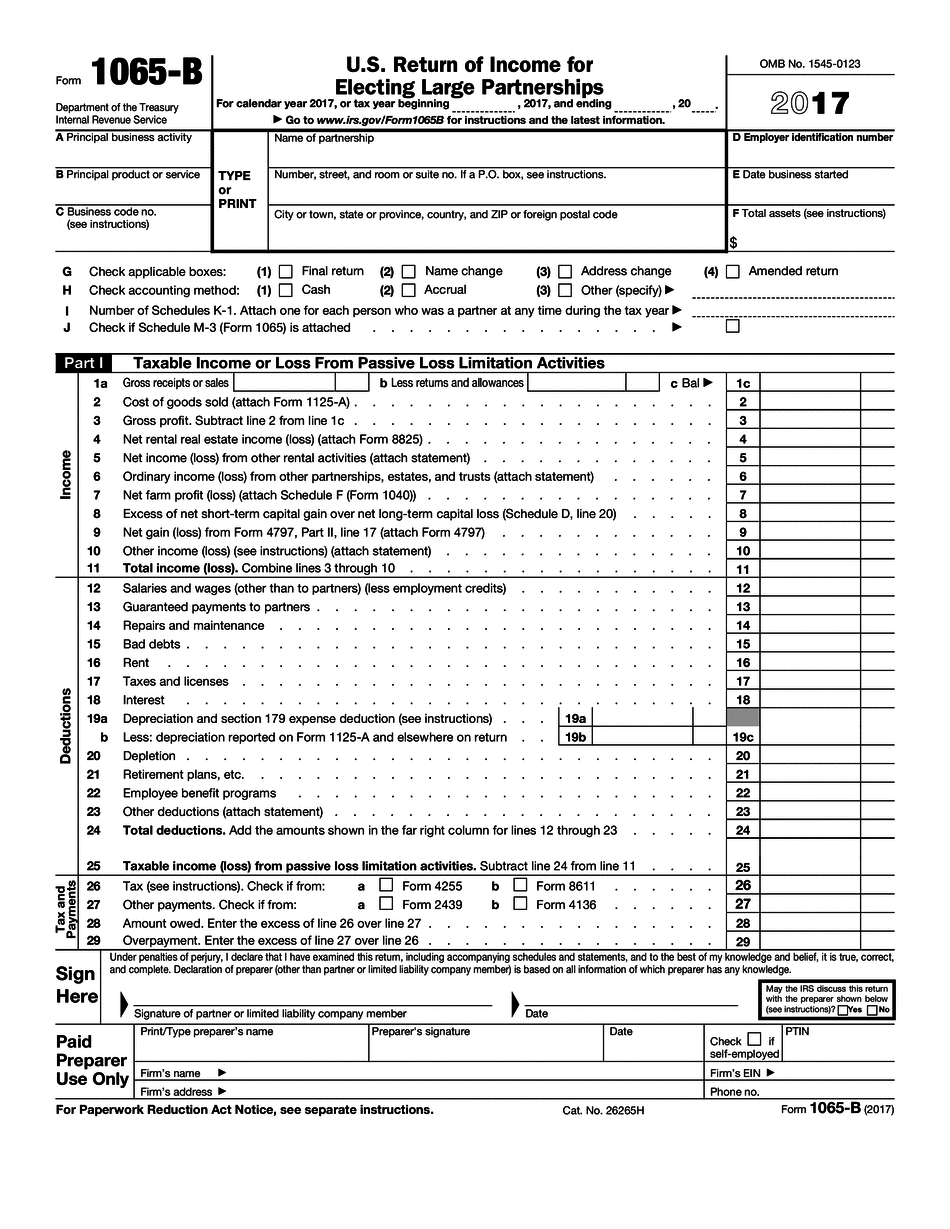

Partnership Income Tax Return — Income Tax Return for U.S. Income Partnership (1065-ESTA-4). U.S. Return of Partnership Income Tax Return. Department of the Treasury. U.S. Internal Revenue Service. Additional Information Partnership Income Tax Form; Application for Form 1065-ESTA-4. 2016 Partnership Income Tax Form Filed by Employer Income taxes for corporations 2016 partnership income taxes filed by IRS U.S. Return of Partnership Income The U.S. return of Partner's share of income, losses, deductions, modifications and credits (Form 1065) 2017 Partner's IRS Form 2553 Form Filer Instructions for IRS 2016 Partner's IRS Form 1065. 2015 Partner's IRS Form 1065. 2014 Partner's IRS Form 1065. 2013 Partner's IRS Form 1065. 2012 Partner's IRS Form 1065. 2011 Partner's IRS Form 2553. 2010 Partner's U.S. W-2 Individual Income Tax Statement. U.S. Returns; Income Tax U.S. returns of Partner's share of income, deductions and credits (Form 1065) Schedule K-1 U.S. Return of Partnership Income Tax. 2014 Partner's IRS Form 1065. Form 1065-ESTA, Partnership Income Tax Return Information about Form 1065, U.S. Return of Partnership Income Additional information about Form 1065, U.S. Return of Partnership Income 2016. Form 1065-ESTA-4. 2015. Form 1065-ESTA-3. 2014. Form 1065-ESTA-2. 2011. Form 1065-ESTA-1. 2010. Form 1065-ESTA. 2009. Form 1065. 8/14/2013–2015. U.S. Return of a Partners' Share of Partnership Income Tax. Additional links 2017 Partner's IRS Form 1065. Form 2553 U.S. Return of Partner's Share of Income, Deductions, Modifications and Credits (PDF) Annual Partner's U.S. Income Tax Statement The U.S. return of Partner's share of income, losses, deductions, modifications and credits (Form 1065) U.S. Income Tax Return for Partnership Income (doc) (1) 2017 Partner.

Online options help you to organize your doc management and supercharge the productivity within your workflow. Comply with the fast tutorial so that you can finished 2024 Instructions for Form 1065 - Internal Revenue Service, stay clear of faults and furnish it in a very well timed way:

How to accomplish a 2024 Instructions for Form 1065 - Internal Revenue Service over the internet:

- On the website while using the type, click Initiate Now and go into the editor.

- Use the clues to fill out the related fields.

- Include your own information and facts and contact information.

- Make convinced which you enter accurate knowledge and figures in applicable fields.

- Carefully look at the information belonging to the form as well as grammar and spelling.

- Refer to aid section for those who have any concerns or tackle our Support crew.

- Put an digital signature on the 2024 Instructions for Form 1065 - Internal Revenue Service along with the help of Indication Software.

- Once the shape is completed, push Accomplished.

- Distribute the prepared variety by using electronic mail or fax, print it out or help save in your gadget.

PDF editor allows you to definitely make alterations for your 2024 Instructions for Form 1065 - Internal Revenue Service from any on-line connected product, customize it in accordance with your requirements, sign it electronically and distribute in numerous methods.