Award-winning PDF software

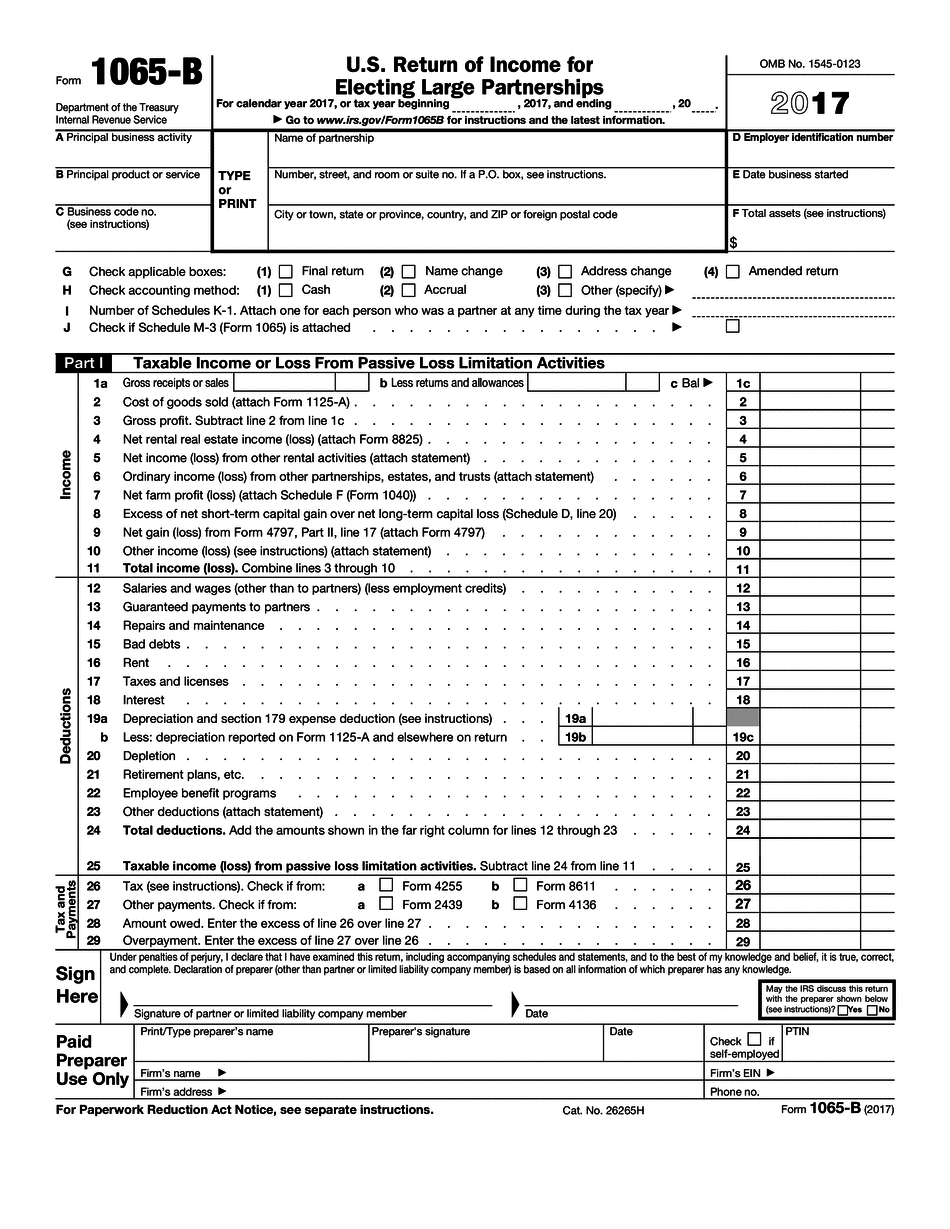

How To Fill Out Form 1065: Overview And Instructions - Bench: What You Should Know

PDF — (File an Amended Answer). For the filer's spouse, a statement that the filer intends to file his Tins. For all other filers or their spouses, the name and TIN of each qualifying child who will claim the filer as either a qualifying child or dependent (TIN) and who will report the dependent parent's income. Form 8889: Amended U.S. Individual Income Tax Return Filing your return as a taxpayer other than in the United States, or reporting income of a person who is a U.S. citizen or a resident alien of the United States Filing a Form 8889 returns can be helpful in filing a joint return or for filing a return to claim an exemption for dependents (children) or individuals who are eligible for a U.S. or state “married filing separately” filing status. An 8889 return should be filed by the due date posted on your Form 1040 return. Forms in the 1040 format can be used if the due date is more than 3 months past due on your tax return. Form 8889: Amended U.S. Individual Income Tax Return You can find more information about filing Form 8889 Return at You need to file a Form 8889 Return if any of the following applies to you: You have a joint return. The IRS cannot assess any tax or pay you any tax unless you file a Form 8889 Return on or before the due date on your tax return. You or the tax filer are residents of a U.S. territory, possession, or U.S. commonwealth, including Puerto Rico. (Note if a U.S. commonwealth is not listed, you must also file your return on paper.) Your spouse, if you file a joint return, has no U.S. income. You or your spouse have a household income of less than 400. You or your spouse have a household income between 400 and 1.99 million. For example, a person in this income range has a household income of 1.99 million and does not pay any U.S. taxes. For more information, see Form 8889 and Information for the U.S. Resident Taxpayer and Nonresidents of the United States Form 8889 Return Examples Example A: You file Form 8889 for the 2024 tax year.

Online alternatives allow you to to organize your doc management and enhance the efficiency of your respective workflow. Abide by the fast information to be able to finished How To Fill Out Form 1065: Overview and Instructions - Bench, refrain from errors and furnish it inside a well timed way:

How to complete a How To Fill Out Form 1065: Overview and Instructions - Bench on-line:

- On the website while using the variety, click Begin Now and go with the editor.

- Use the clues to complete the relevant fields.

- Include your own information and phone data.

- Make confident which you enter right info and figures in best suited fields.

- Carefully take a look at the subject matter in the type as well as grammar and spelling.

- Refer to assist area in case you have any queries or deal with our Guidance workforce.

- Put an electronic signature on the How To Fill Out Form 1065: Overview and Instructions - Bench when using the guidance of Sign Tool.

- Once the form is concluded, press Executed.

- Distribute the all set type by way of electronic mail or fax, print it out or help you save with your device.

PDF editor will allow you to make alterations to your How To Fill Out Form 1065: Overview and Instructions - Bench from any internet linked system, customize it based on your needs, indicator it electronically and distribute in several methods.