Award-winning PDF software

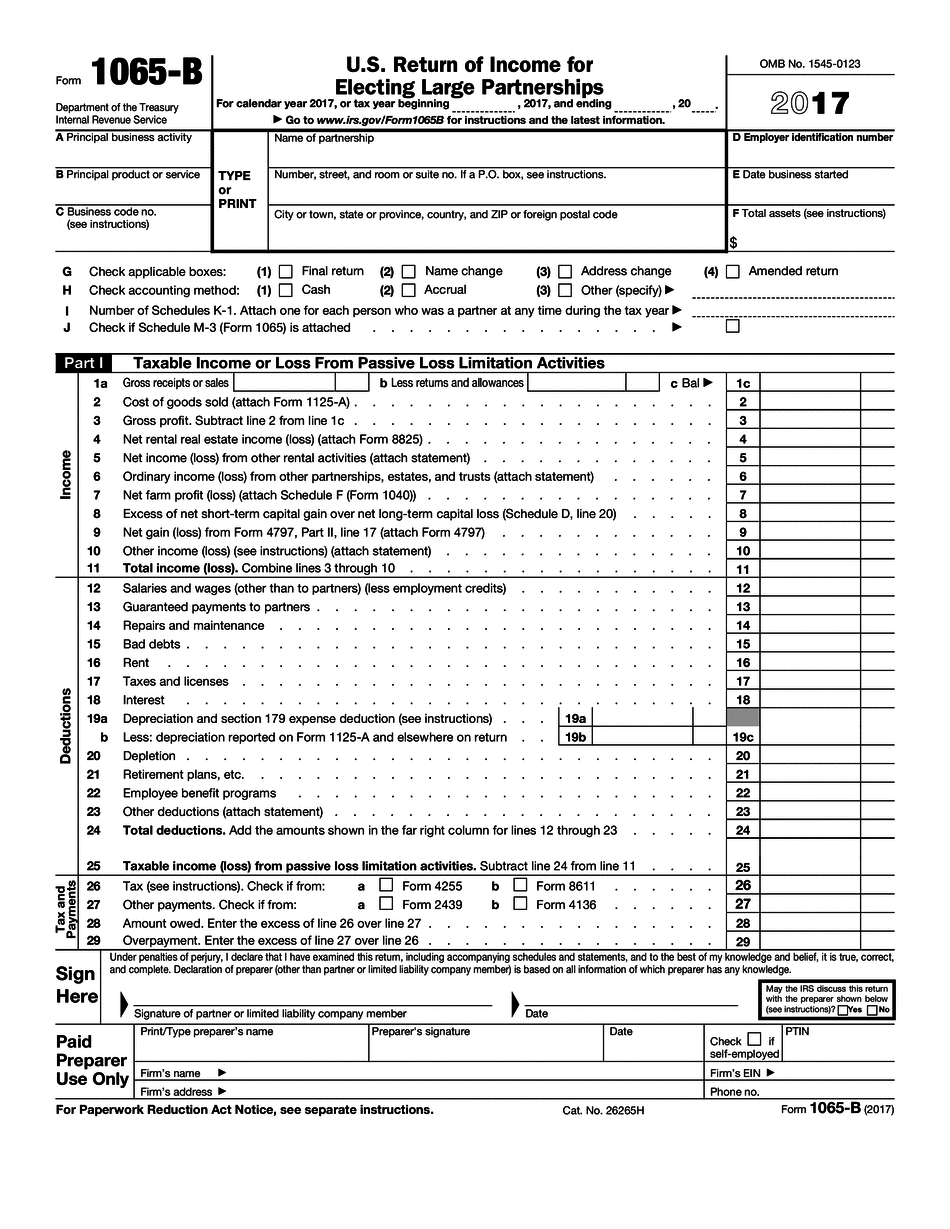

Form 1065-B for Gilbert Arizona: What You Should Know

Enjoy fresh pasta with fresh cut meats served with your choice of salad and bread basket, served with homemade Caesar dressing, or a freshly baked Italian omelet from the deli window with fresh tomatoes, fresh mozzarella cheese and fresh basil. We believe that if you eat at Freshness, you will have a good time and enjoy the quality food and atmosphere. Please call ahead (Mon-Sun) to place your order and pick up your sandwich. We are also conveniently located in the new Gilbert Mills Town Center Mall. (Store address P.O. Box 14, Gilbert, AZ 85243) For more information call or visit Form 1065, U.S. Return of Partnership Income — Arizona Sales Tax Return If you bought food, lodging or services as a partner with a business owner you may pay your taxes by filing a Partnership Return under Arizona Sales Tax Code Section 16-1101. The Partner Form 1065 is the form that you must use if this was the first time you bought food, lodging or services as an owner and partner of a business as part of a partnership. It is only required if you bought the item(s) through an agent. You can download a Partner Form 1065 PDF. Form 1065 — Schedule B-1 for Partner (Form 1065) If you bought food as a partner with a business owner this tax return must be filed by April 15 to qualify as a Partner with Arizona Sales Tax Authority for any tax years from the date of purchase to the due date. Your partner's Arizona Sales Tax Return must include this Schedule B-1 : Date: Year: Number of years: Amount you paid to buy Total Amount of Form 1065 — Schedule B-1 for Partner (Form 1065) Form 1065 is a paper work that you must prepare to be effective on April 15. If a business is not considered the same business as the Partnership return is subject to the Business Income Tax (BIT).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065-B for Gilbert Arizona, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065-B for Gilbert Arizona?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065-B for Gilbert Arizona aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065-B for Gilbert Arizona from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.