Award-winning PDF software

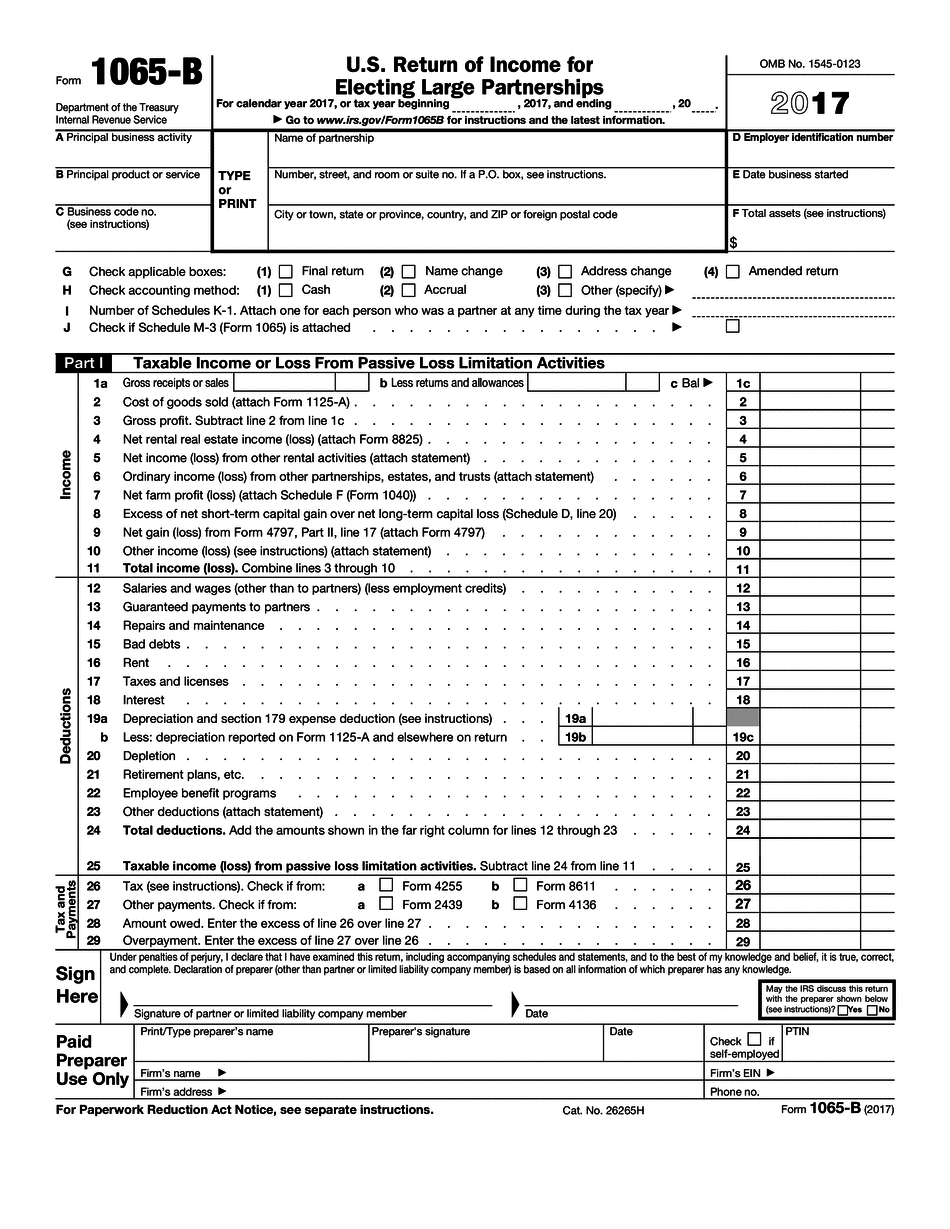

Form 1065-B for Palmdale California: What You Should Know

In California, for taxable years that end on or after February 23, 2012, a partnership tax return is filed with Part IV with Schedule B. For taxable years that end on or before February 23, 2012, a partnership return is reported on the partner's line of the state return that applies to the partnership. If the partnership is a limited partnership, a partnership return is reported on the partner's line of the partner's Form 1065.” California Partner's Guide to Partnerships. Disclaimer — Any of these tax preparers or information providers must be given credit for making it easy for you to do your tax return. In addition to the resources listed above, there are several other links I have written on tax preparation for partnerships. Tax-Sensitive Businesses In the past few years, there have been tax laws, policies and regulations being pushed through that are highly taxing non-tax sensitive businesses and individuals. The impact is that tax-sensitive businesses are being increasingly taxed with tax-sensitive individuals. Many of these new tax laws were created through the so-called “Corker provision”, in which the Senate GOP introduced a tax reform bill which includes a provision to “deem non-tax sensitive firms as tax-sensitive.” The provision requires that the tax return of any business should include information such as gross receipts, deductions etc. It does NOT require that taxes have been paid on any of these items, yet it may cause a tax return to be filed that may not be acceptable to the IRS. These changes are impacting a number of businesses, both in California and in other states. Some of these business are being affected by: The new rules are going to further limit what employers can claim for tax deductions, thus decreasing the tax benefits employers may have in California and other states. Some of the biggest implications are on business owners with multiple employees, small business owners with zero or less than employees, and even the self-employed. There are some small business owners who have been impacted by these rules and their tax returns are not suitable for filing with the IRS, yet they are in compliance with the law. I don't have a good answer as to what to do about this. I suspect it is best to consult with your lawyer and/or tax preparer to see just how best you and your business can navigate these changes.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065-B for Palmdale California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065-B for Palmdale California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065-B for Palmdale California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065-B for Palmdale California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.