Award-winning PDF software

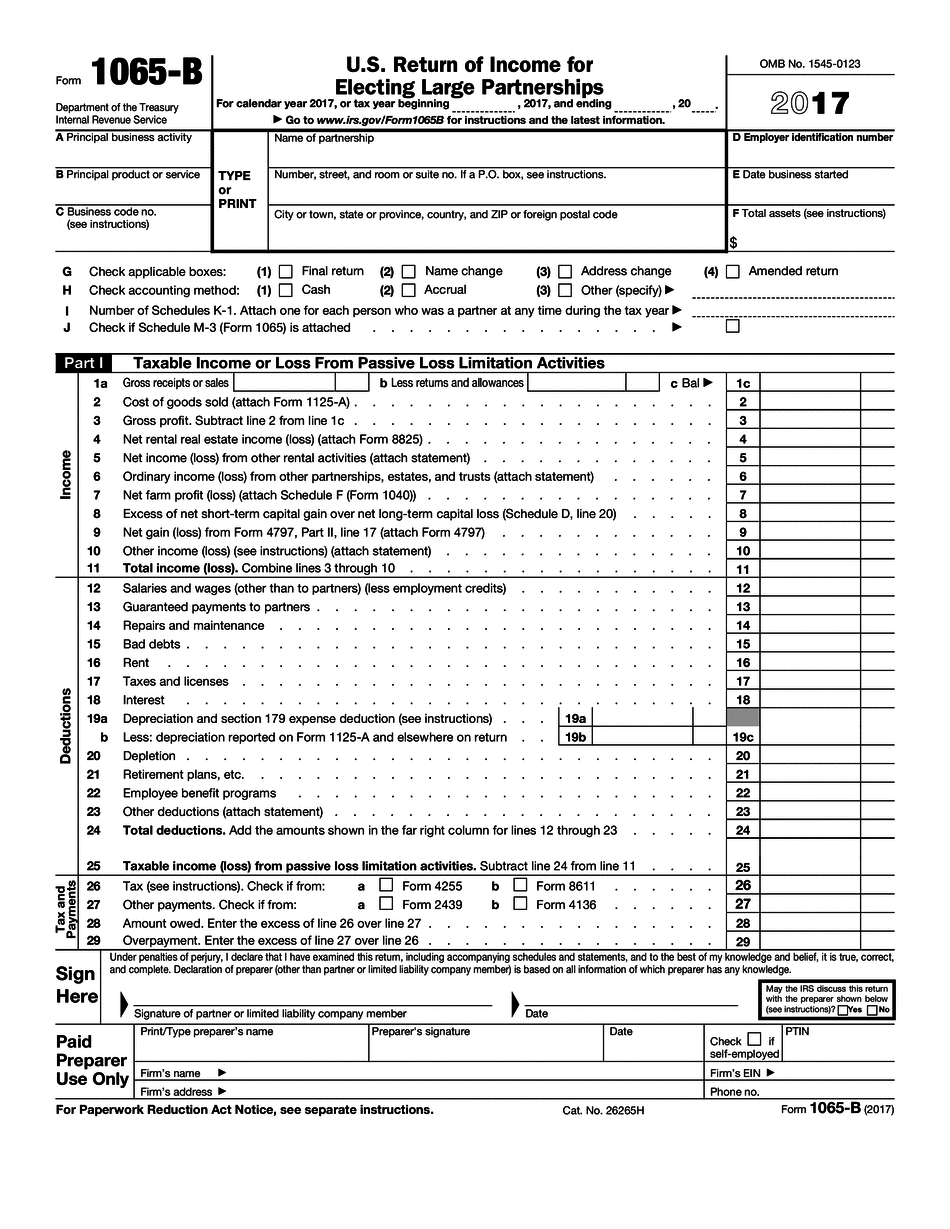

Form 1065-B for Paterson New Jersey: What You Should Know

New Jersey Income Tax Return for Partners and Affiliates of LCS and Partnership Interests Note: Forms NJ-1065 (Schedule B-1) for Paterson New Jersey are available on our website, the division's website is also accessible through our search facility, NEW JERSEY PAYE TAX REQUIREMENT We determine each person's gross income and the amount of taxable income each partner will be required to pay. Partnership gross income includes: Gross income from business activities including the sale of property or the making of a profit; Gross income from rentals of real estate or other personal real or tangible property; Gross income from farming; Gross income from partnerships for the rental or use of real property. Individuals who are not engaged in the business of owning, operating, managing or acting in an active role in a business are not eligible to be partners unless they: are actively or semi-actively engaged in a trade or business, but not engaged in the actual ownership, operation, management or management activities of the trade or business; are an elected or appointed governmental official, or a person or entity described in paragraph (4), paragraph (3), (6)(c), or paragraph (3.5) of this section, and are engaged in the actual business of engaging in electioneering communications. We determine whether someone, other than an elected or appointed governmental official, is engaged in the actual business by determining which category of taxpayer they fall into. If the IRS determines someone falls into one of the specific categories and the partner is not required to pay federal income tax, they: shall be deemed to be a nonresident individual, with federal income tax return filing requirements shall be subject to penalties if they fail to file a return, pay the tax they owe, or comply with any other terms or conditions imposed by law (or under penalties in the absence of such penalties); or shall be deemed to be an organization controlled by, or controlled or operated for the benefit of, an individual to the extent that a partner's tax responsibilities would be extended to the individual under this paragraph. We will inform partners that they were considered nonresidents for purposes of this IRS provision.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065-B for Paterson New Jersey, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065-B for Paterson New Jersey?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065-B for Paterson New Jersey aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065-B for Paterson New Jersey from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.