Award-winning PDF software

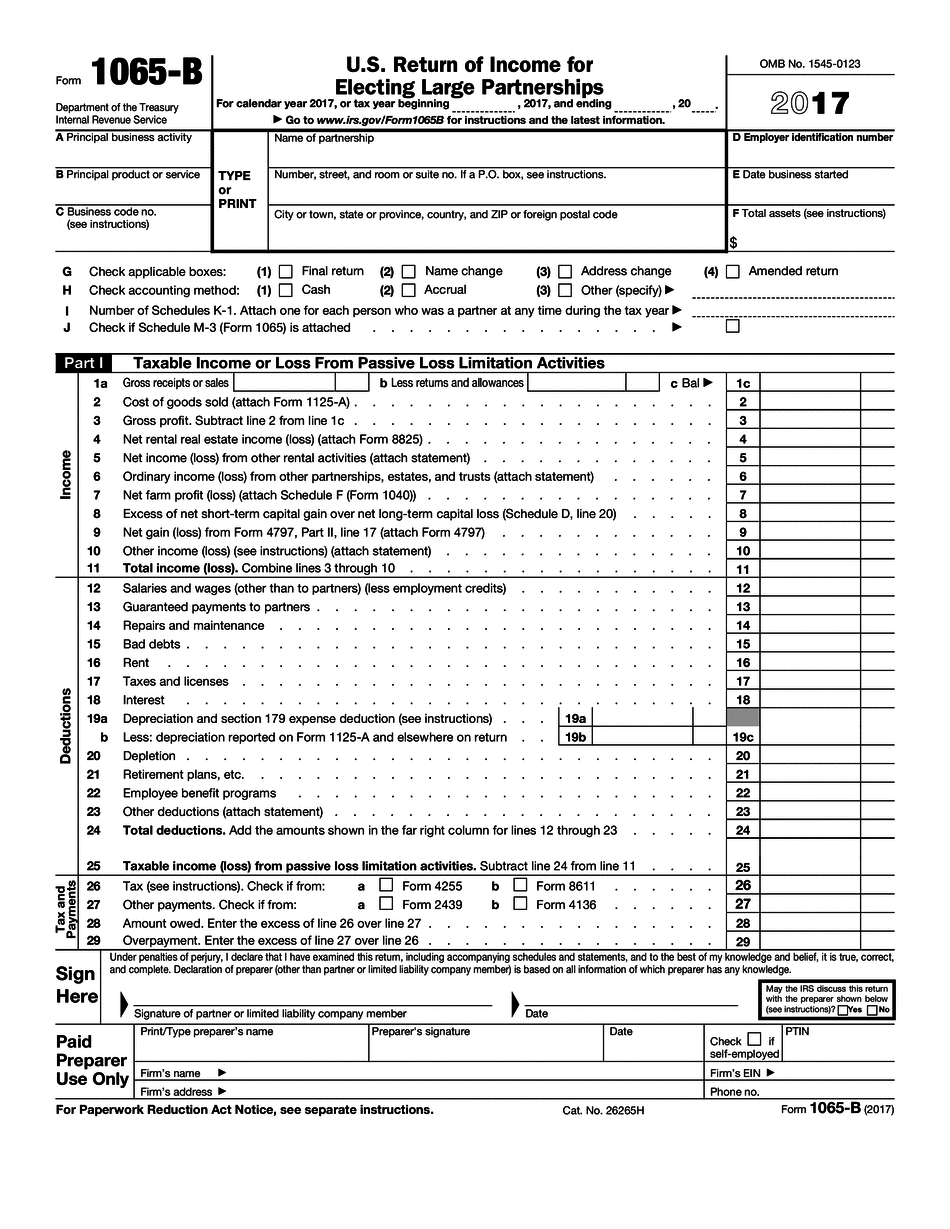

Form 1065-B for Tampa Florida: What You Should Know

Form W-2 (Form 1099-DIV) The Florida Franchise Tax Board has released new information on its publication Form W-2 (Form 1099-DIV), as reported by partnerships, sole proprietorship, and S corps. Each partnership Tax Exempt Status of Business Entities — Form 843 TAB has an updated version of this “Business Tax Exempt Status of Business Entities” publication. TAB Publication 843 – 2024 has updated information and is the most updated version of the publication. Some changes: “The IRS amended the list of exempt organizations for the tax year ending December 2016. Beginning with the 2 tax years as well as in future years, the IRS will begin issuing Form 843-A when an individual is designated as an exempt organization due to special circumstances. Form 843-A is an official document issued by the IRS indicating an organization is an exempt organization. Exemption from taxation applies only to certain business activities. For information on exemption from taxation from the United States, refer to Publication 515, Tax Guide for Small Business, Inc. For additional information, including definitions and procedures, contact the exempt status unit, TAB, or IRS, respectively.” Form 843 (PDF) Exempts an individual from paying business tax. Form 843 describes the specific business activities and is issued to an individual or entity. Each partner reports the appropriate business entity. An individual may also be included in the filing. Schedule M-10 (Form 941) (Rev. January 2018) A business entity has many requirements that must be met before it qualifies for exemption from paying the 5.25% corporate income tax. Form 941 (PDF) describes each requirement. Schedule M-9.2: (PDF) Schedule M-8 (Rev. Aug. 2016) A filing for tax exemption from the Individual and Corporate Income Tax. This is a form that is used to report the income generated by an organization, but is not a tax return itself. S Corps, Partnerships, and Partnership Income To be recognized as a partnership, an S corps must meet the following requirements: S corps must be authorized to carry on business in the state where the organization is established The organization may only have a maximum of six members If an authorized member leaves an S corps, each remaining member of the S corps may be considered an independent proprietor.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065-B for Tampa Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065-B for Tampa Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065-B for Tampa Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065-B for Tampa Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.