Award-winning PDF software

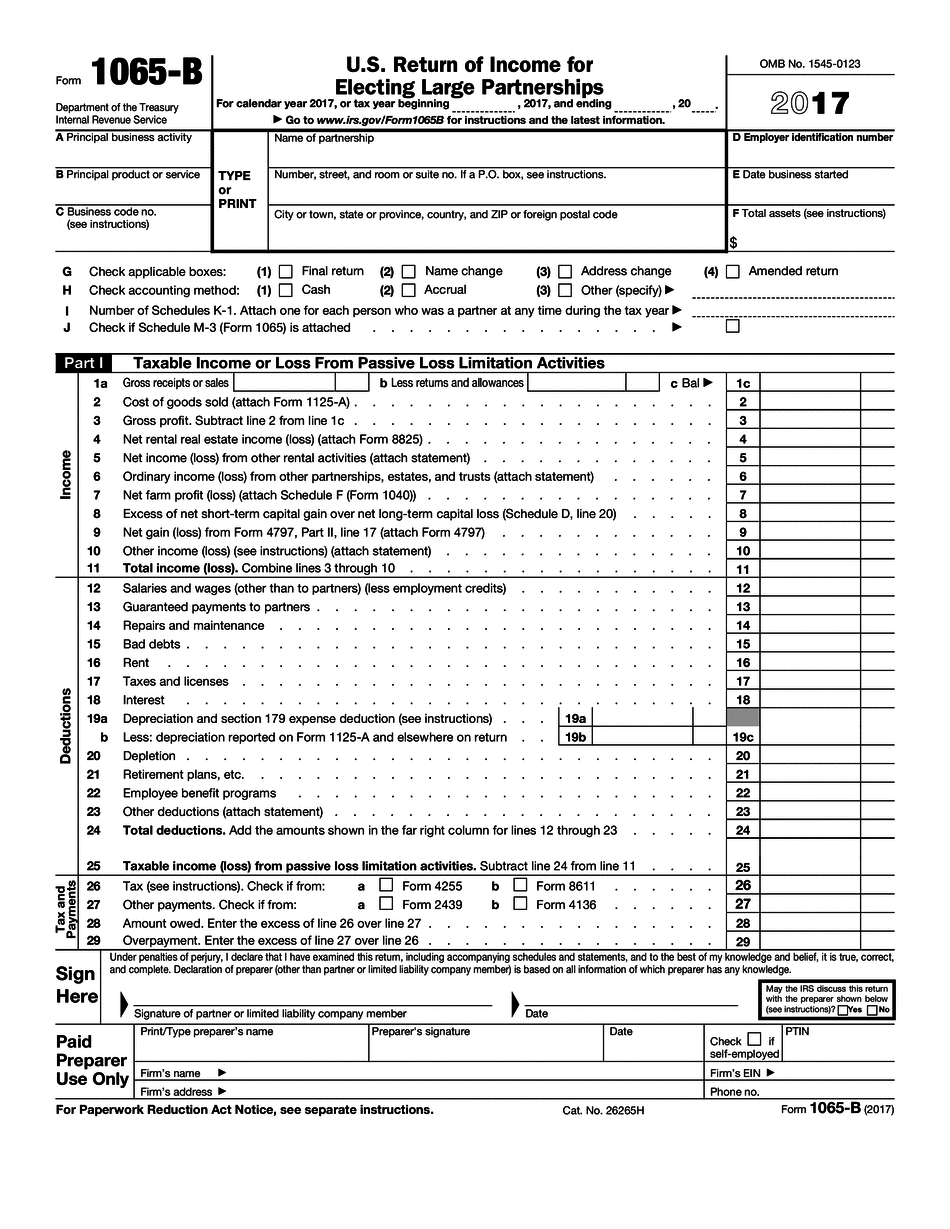

Huntsville Alabama online Form 1065-B: What You Should Know

The partnership form will also require a certificate of insurance on all partners, and a Schedule K‑1 to be filed. Tax Forms and Publications — Huntsville Asset Management Division State of Alabama does not require a partnership tax form or a Form 1065 in order to collect sales, use and other state income tax. But, the Alabama Code does not specify whether the “partnership tax” is an obligation, an optional entity, or something else entirely. The Huntsville Asset Management Division of the Alabama Department of Revenue offers several partnership tax packages that can simplify the burden for small business owners and provide tax return preparation. The packages include a partnership tax form (Form 65), a partnership tax certificate (Form 11S), a partnership tax schedule (Form 1065), and a partnership tax guidebook (Form 20-B). The first two items are required to have both partners complete the item and send it to the Department of Revenue. The guidebook is more streamlined and only requires one partner to complete it. Only the partner that submitted the other partner's Schedule K-1 must mail it. All items are mailed to the address listed in the Alabama Public Access System and are considered ready to be filed with the Alabama Department of Revenue. Tax Forms and Publications — Huntsville Public Access System (HAS) As long as there is a paper Form 1065 there are other resources available that can help taxpayers fill out its items (e.g. the paper Form 1065 is filed online). Also see CHSCT. Sales, Use and Gambling Huntsville does not have a tax on gambling. Partnership/Limited Liability Companies Partnership Tax CertificateForm 1065PublicationPublication for 10Sales, Use and GamblingPartnership Tax CertificatePublication of 10Sales, Use or Gambling. Business Licenses A business license is required for a retail establishment, hotel, motel, restaurant, barber shop, or other business activity or business establishment that will have gross receipts over 25,000 or if the business has gross receipts and paid sales tax as of June 30 of the previous year. Only a business license is required for a residential-based business where the residential property is leased to any person for a rental period of more than 30 days. Partnership Tax CertificateForm 1065Publication of 10Sales, Use and GamblingPartnership Tax CertificatePublication of 10Sales, Use or Gambling.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Huntsville Alabama online Form 1065-B, keep away from glitches and furnish it inside a timely method:

How to complete a Huntsville Alabama online Form 1065-B?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Huntsville Alabama online Form 1065-B aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Huntsville Alabama online Form 1065-B from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.