Award-winning PDF software

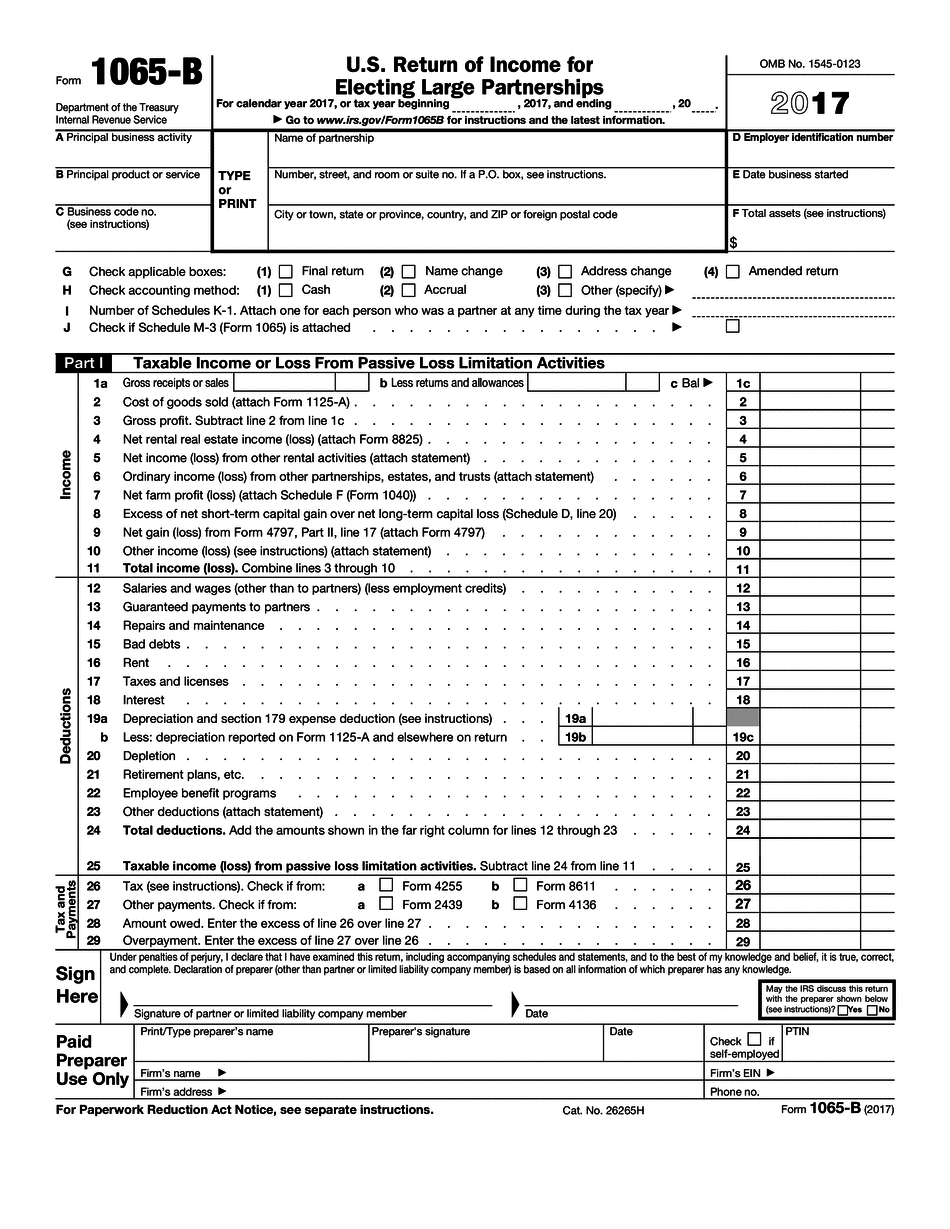

Lee's Summit Missouri online Form 1065-B: What You Should Know

Our dedicated faculty, staff, residents, and alumni work hard to ensure that each student develops in a way that will allow them to excel both individually and academically. Lee's Summit High School If you have received a letter from a Missouri taxing authority regarding your partnership income, please call the office of the Missouri Department of Revenue at and leave a message with their office phone number. There is a 7,000 limit for state partnerships. The address for the Department of Revenue's office is as follows: Office of the Secretary of State 501 N. St. Louis St., Room 5 Saint Louis, MO 63108 Phone toll-free in Missouri or toll-free in other states To learn more about the Missouri Department of Revenue, go here. If you would like to purchase a paper copy of the partnership tax return, click here If your partnership is currently a Missouri tax partnership, and you would like to know what to do now, click here Filing a 1099-K for LCS When you establish an LLC, you must file an Oregon Form 563 and obtain an Employer Identification Number. On this IRS Form 563, you will need to list all the participants or owners and any income, sales, expenses or real, personal, business, agricultural, or other property (collectively, the “Participants”) to the business. There is a maximum income and capital limit for the LLC (1099-K). The total amount of sales and income reported on this Oregon LLC Form 563 is limited to 5,000 per person, per taxable year. To find out if your LLC is required to file a Wisconsin Form 565, click here If a Wisconsin LLC is required to do a Form 565, the Wisconsin form is the Form W-2. If your LLC is not required to file a Form 565, the LLC must file a Schedule C-EZ under the section “Management Agreement,” which can include an agreement, a waiver or an exception. The Schedule C-EZ is not filed with the Form 1065; it is an optional report and must be attached to the Schedule 1065. You also must file Form 1065 with the state of your incorporation and your name must match the name of your legal entity.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Lee's Summit Missouri online Form 1065-B, keep away from glitches and furnish it inside a timely method:

How to complete a Lee's Summit Missouri online Form 1065-B?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Lee's Summit Missouri online Form 1065-B aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Lee's Summit Missouri online Form 1065-B from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.