Award-winning PDF software

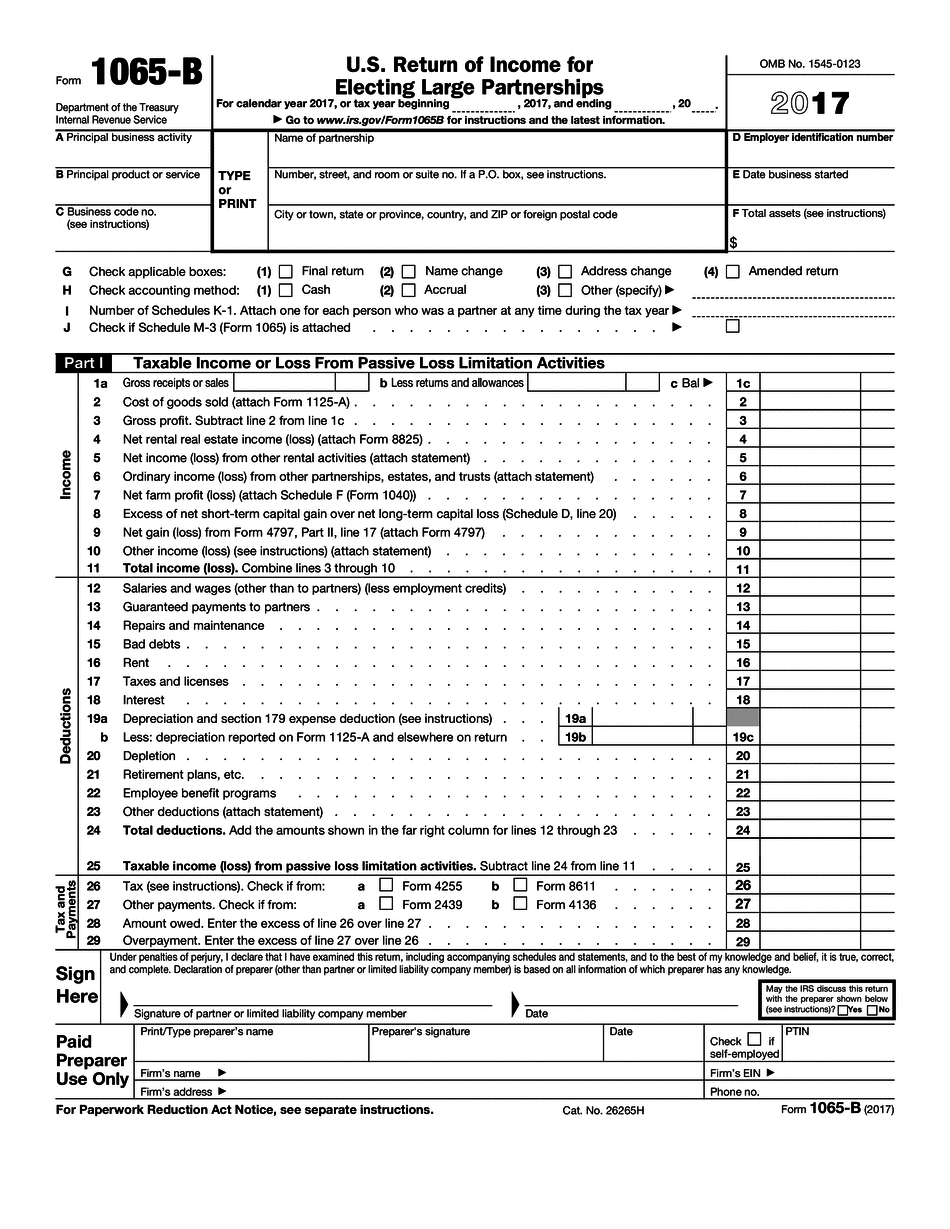

North Las Vegas Nevada Form 1065-B: What You Should Know

For help with additional tax questions, see the AARP Foundation website at. AARP Foundation: AARP Tax-Aide Service is a nonprofit organization dedicated to helping all AARP members and their families prepare and file their taxes using its tax-deductible tax preparation services. AARP Tax-Aide serves about 50,000 of the more than 180,000 AARP members. The service can provide answers to general tax questions and basic information to help AARP members prepare their own taxes and learn more about their obligations to the government. If you have a general tax question, click here and call. General Tax Questions — Help for Older Adults — Nevada Department of Social Services If you are age 55 and older, a social services office in the county in which you reside may be able to provide assistance through a non-profit organization. If you are age 55 and older and a Nevada resident, you may qualify to receive a free tax preparation program offered through Social Security Administration. Social Security and other programs offer free tax preparers who file income tax in your names. You can find a list of these organizations on the Internet at. Free Tax Preparation The Nevada Department of Taxation provides free tax preparation to all taxpayers age 55 and older, with special consideration to those who have difficulty using one of the state's tax-preprving services. You need to provide a Nevada ID number and a valid phone number to apply for services. Taxpayers age 55 and over must apply to receive free tax preparation from the Nevada Department of Taxation through their social services or a non-profit community volunteer organization. An application can be downloaded from the Nevada Department of Taxation's Resources page. Social Services in Nevada. Social Services in Nevada is an agency of the Nevada Department of Social Services (DSS). DSS is responsible for social services, health, and education in Nevada, including providing general social services, vocational rehabilitation, and adult education. Community Volunteer Organizers — The Nevada Department of Taxes offers tax-preparation training to community volunteers. The Nevada Department of Taxation and Social Services (DSS) offers free Tax Preparation and Social Services training for citizens.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete North Las Vegas Nevada Form 1065-B, keep away from glitches and furnish it inside a timely method:

How to complete a North Las Vegas Nevada Form 1065-B?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your North Las Vegas Nevada Form 1065-B aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your North Las Vegas Nevada Form 1065-B from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.