Award-winning PDF software

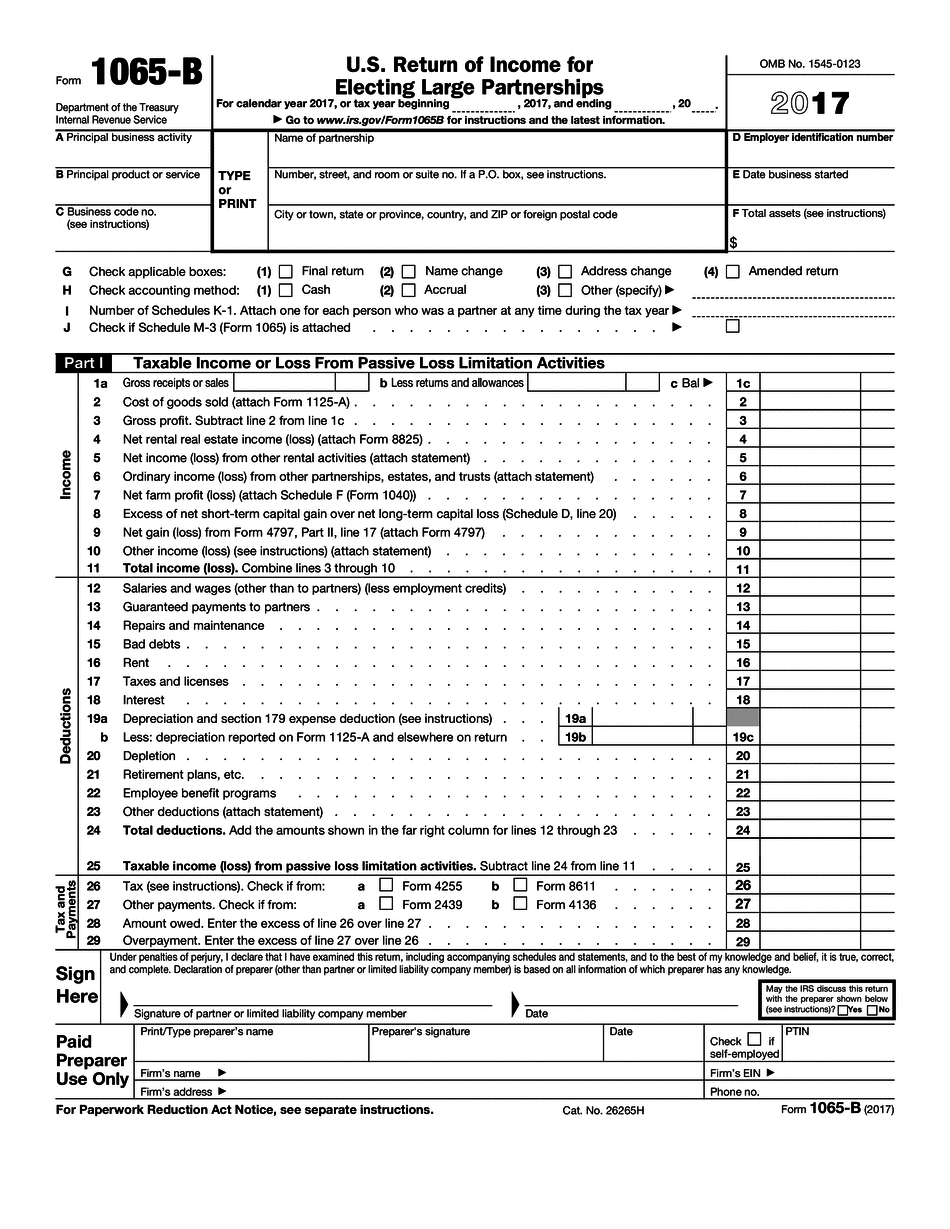

Printable Form 1065-B Broken Arrow Oklahoma: What You Should Know

The draft Financial Plan is available online or at the Broken Arrow City Clerk's office. All information available on the City's website is available for public review. All documents may be viewed and copied but not edited. To access certain areas of the website, you may be required to log in with a user ID and password. Please note that user IDs are not used for credit card transactions. A valid, government-issued driver's license or photo ID must be presented to the City Clerk's office. Please contact the City of Broken Arrow at Broken with questions about the website. City of Broken Arrow Oct 17, 2024 — City of Broken Arrow Proposed Tax Ordinance As adopted by the City Council of Broken Arrow, October 17, 2016. The City of Broken Arrow recently adopted Ordinance No. 2 (PDF) to amend an existing tax measure to provide for a 10 percent gross receipts tax and a property tax rate of 4.99 mills (PDF). The ordinance increases the current gross receipts tax rate to 4.99 mills (PDF) on the income from the sale of taxable real and tangible personal property for the City of Broken Arrow. The ordinance also provides for a property tax rate of 4.99 mills on the income of partnership income for the City of Broken Arrow. Ordinance No. 2 establishes annual gross receipts taxes from the sale of taxable real and tangible personal property for the City of Broken Arrow. The gross receipts tax on the gross receipts from the sale of tangible personal property is established through an annual tax on all gross receipts from the sale of tangible personal property made during the calendar year in which the effective date of the ordinance is on and after the first day of November in each year. The City of Broken Arrow has established the gross receipts tax which is a 3.5 percent gross receipts tax on gross receipts from the sale of tangible personal property for each taxing body. The gross receipts tax rate will be increased annually beginning on January 1, 2017, and is subject to inflation and increase with passage of the City Annual Budget. If the gross receipts tax rate is increased, the property tax rate will also increase quarterly until the tax rate is reduced to 0.00 percent on September 1, 2022. The gross receipts levy is subject to appropriation by the City Charter. City of Broken Arrow.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1065-B Broken Arrow Oklahoma, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1065-B Broken Arrow Oklahoma?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1065-B Broken Arrow Oklahoma aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1065-B Broken Arrow Oklahoma from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.