Award-winning PDF software

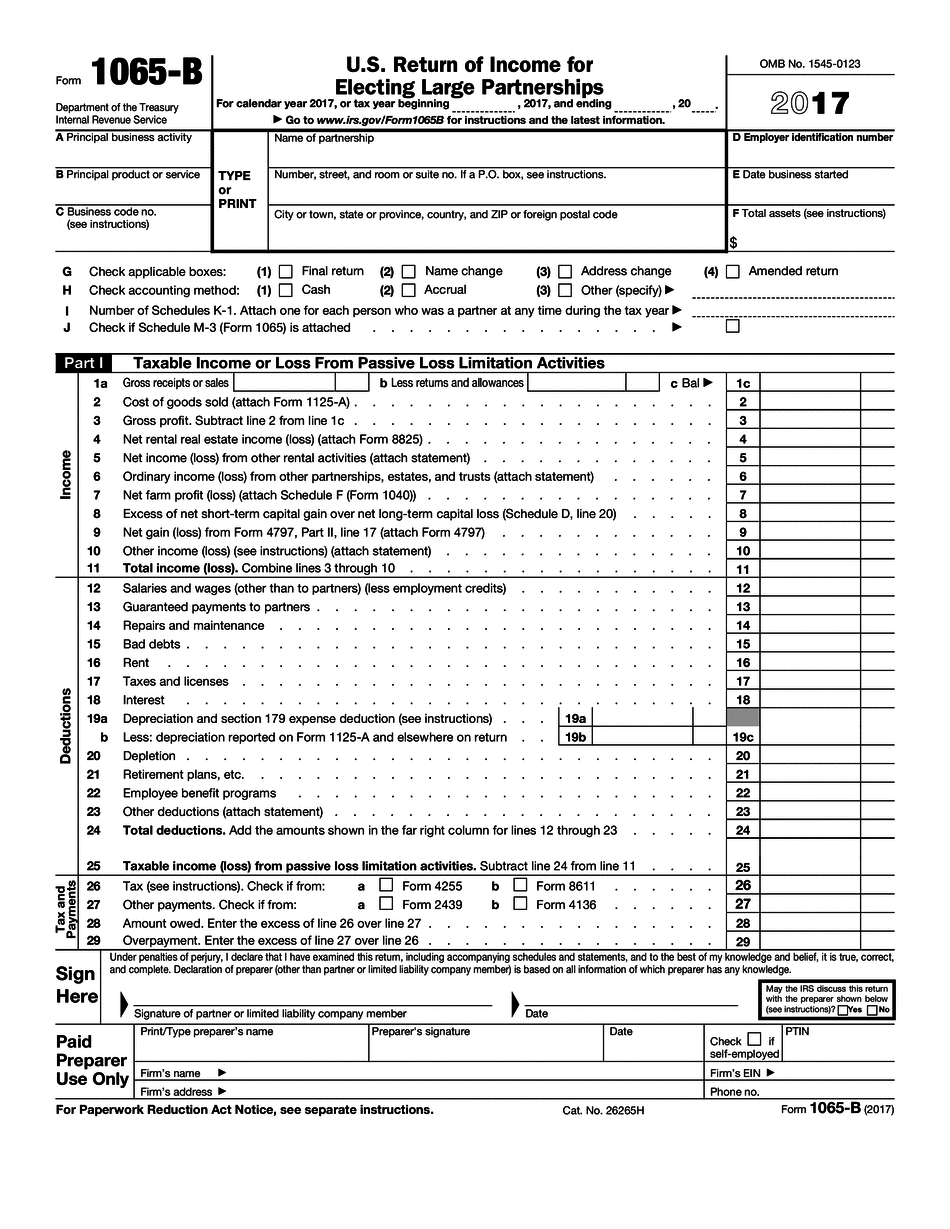

Wayne Michigan Form 1065-B: What You Should Know

For most owners with the help of a tax advisor, there is no good reason to apply for credit. However, if it is one of the very few cases where the owner has a significant improvement, this is the preferred way for such owners to avoid property tax liability. Home heating and property tax exemption plans are designed to ensure the most equitable distribution of credit among members. The value of an exemption differs considerably from member to member. Qualify for this credit — Michigan residents that qualify for one or both of the state exemptions for The Home Heating Property Tax Credit, if the property owner has used in the previous 12 months: A qualified energy efficiency investment or a qualified home heating system. In most cases the home heating is the major investment, so the tax savings are substantial. In fact, if all the owners use the heat pump system (see below), then for the owner only, the combined tax savings would amount to 40 percent. Michigan's residents who do not qualify for home heating tax credits, do not have to pay property taxes and do not need a credit. For example, the Michigan home heating tax credit for a building is limited to 1,000,000 (including capital or labor) for the permanent occupants (i.e., those living with the structure for five years or more). If the building is rented, the credit will be reduced to 500,000 for five years of occupancy. The Michigan Home Heating Property Tax Credit is valid for up to 10 consecutive years (or 50 years if paid in full). In 2014, the state had 2.8 billion in property taxes to pay. Only 1 billion, or 2.6 percent, was derived from tax deductions for home heating energy efficiency. The Home Heating Property Tax Credit is a credit against the property tax. As a credit it is not a tax. It is however one element in a state of mind about the value of a home, the relative importance and desirability of energy efficiency, and the desire to reduce costs. It promotes the values of energy efficiency and sustainability as well as reducing costs. Furthermore, it fosters the benefits of building sustainability in Michigan. Incentives to increase energy efficiency and sustainability are the focus of this act: (1) In general.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Wayne Michigan Form 1065-B, keep away from glitches and furnish it inside a timely method:

How to complete a Wayne Michigan Form 1065-B?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Wayne Michigan Form 1065-B aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Wayne Michigan Form 1065-B from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.