Award-winning PDF software

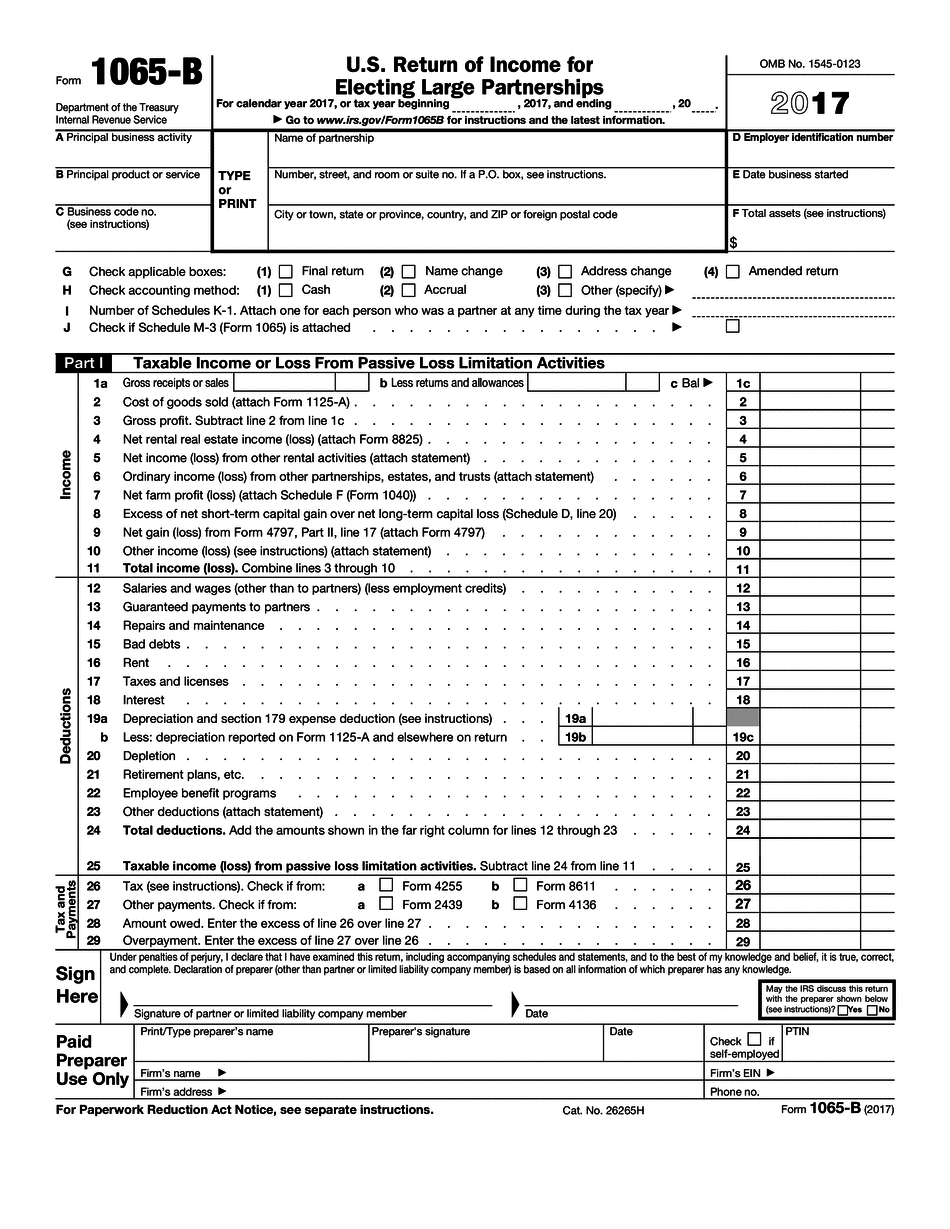

Form 1065-B ND: What You Should Know

This information is helpful for figuring out your partnership tax liability. Partners can report partnership income in either a U.S. or foreign country. The foreign country's tax code for that partnership applies to partnership information provided to income tax returns filed with the country's tax authority. If you are a U.S. resident, your partnership income is generally included in your own country's income tax return. See the partnership's page at on the topic of incorporating. The partnership declaration form contains information such as: the name and address of each partner; a description of the income and taxable incomes; any payments you made to partners; the dates on which you completed the Form 1065-B (a check or money order, made payable to the “U.S. Treasury Department” is acceptable; if you used a check or money order, the check or money order must be properly endorsed), and the names and addresses of the people authorized to act on your behalf at any time, for the purpose of determining the date of your partnership tax return; a description of the source of any income, of any deductions, and of taxable income and taxes paid; a description of any property provided to each partner for the partnership, including in its possession or control and any property delivered to each partner by delivery service (such as mail, courier service or express courier service), if the property was provided at your personal and active expense; each partner's total or partial exemption which was determined prior to entering into your partnership. There are no time limitations on making an election, once you've submitted the form. The only limitation is that each partner must include a written affidavit with their return certifying that they have made the election. This election can be revoked at any time by the partners for any reason. The IRS sends all partner returns electronically. You can see if you are required to file your partnership return by visiting the partnership's page at . Partners can avoid some reporting requirements by filing Form 1065-B. If a partnership has 100 partners, your personal return alone is enough to determine if you report on your partnership return or file Form 1065-B (which is filed with the partnership's Form 1065-B). This form provides detailed information about income and taxes paid, so you can make this election. Form 1065-B is the only election form that does not require the spouse and any children to file a separate return.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065-B ND, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065-B ND?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065-B ND aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065-B ND from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.