Award-winning PDF software

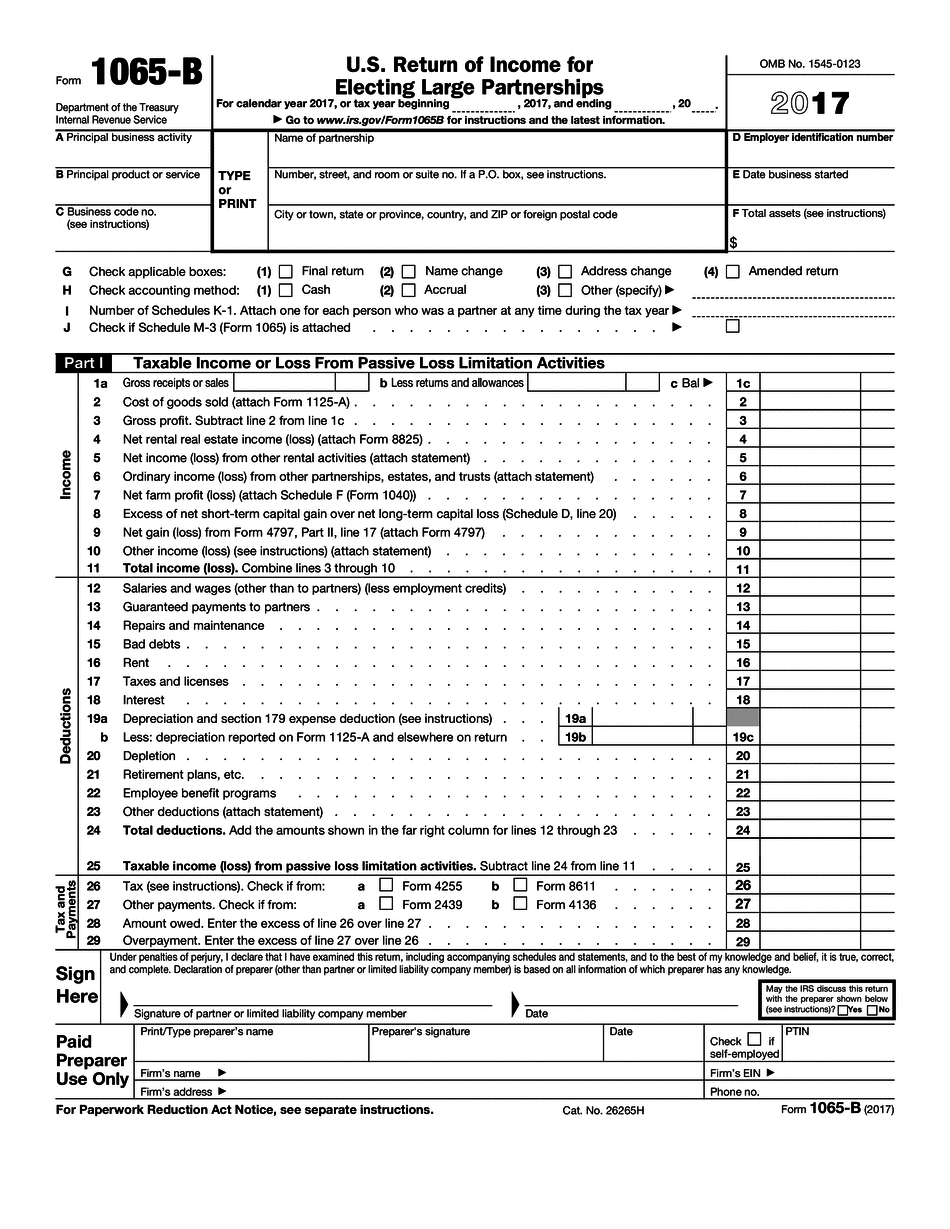

Vermont online Form 1065-B: What You Should Know

Form 5038, Payment of Taxes for Tax Years 2018, 2019, and 2020 (Effective May 2019) What to Do? Get a prompt decision on how to pay the IRS and pay with the right tax calculation. Get your decision, even sooner, with the TurboT ax Online Claimant Directing System. Get your tax forms and pay in a few easy steps. (Use TurboT ax Free File or Pay With Direct Deposit) Get the Tax Credit: Your Filing Status Get the Tax Credit: Pay With Checks (If Needed?) How do I pay the IRS? Use the following payment options: Check Make checks payable to the state where you live as explained on the check to the IRS. Note: You may want to include an extra dollar amount in the amount you write. This extra amount is referred to as a “non-refundable service fee.” These fees are not refundable if you miss filing your return. If you pay by mail, mail out your check to us by the deadline. How do I pay the tax that's due? You can pay by credit or debit card via My Account. You can use that option if you use your bank account. If you use PayPal, you need to do the following to make sure we have the correct amount in your account by the due date: Pay your balance by credit/debit card. Keep your email with the email to receive a notification when the balance in your PayPal account reaches zero. If this happens, you must call us on to let us know. I'm receiving some bad information about who can and cannot file my tax return. We can't reply to all complaints about state tax return filing, but we can address most problems. For more information, contact us at. I paid to file a return, and I don't have enough money in my account to pay it on time. This may happen if your account balance falls below zero. We'll ask you if you want to pay your tax bill immediately or postpone the payment until the balance clears. If you choose postponement, you could lose the money you were paying for the return. My return was returned as undeliverable. What can I do to avoid a 500 penalty? File a new return and pay the tax.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Vermont online Form 1065-B, keep away from glitches and furnish it inside a timely method:

How to complete a Vermont online Form 1065-B?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Vermont online Form 1065-B aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Vermont online Form 1065-B from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.